Planning for college or training this year? Apply for the Vermont Grant.

Upcoming Events

How to Compare Student Loans

(and choose the best loan for you)

Having options can make things unclear at times. With so many student loan options, and each lender offering different rates and benefits while claiming to be your best option, how can you easily make a choice?

Although VSAC loans are for students going to a Vermont college and Vermont residents (in or out of state college attendees), our loan philosophy is universal: only borrow what you need.

Loan shopping can also be confusing if you don’t understand these four key terms:

Fixed vs Variable Rate

Repayment option

Loan Term

Co-signer

If these terms sound unfamiliar, how can you choose the best option for your financial plan?

Whether you shop for a VSAC loan or another lender, we want you to become a confident borrower as you shop around. The choices you make today will determine the full cost of your higher education experience. Keep reading. We’ll answer the top questions every borrower should ask before signing a loan.

To skip ahead, use the navigation to the left.

Yes, Interest Rates Matter.

A lower fixed interest rate is a good thing, but how much does a difference in rate matter in real dollars—both the amount you’ll pay per month and the total over the entire term of your loan?

Rates as of March 12, 2025

Get the Scoop: Subscribe to Our Newsletter

Stop and shop to get your best rate. It's worth the time.

*Many lenders only offer limited information about their actual rates upfront. They don't provide complete rate details within the range of rates depicted in this chart. The loan rates lenders offer can change at any time. These rates were last pulled on Rates as of March 12, 2025.

Annual percentage rates (APRs) in this video represent fixed-rate student loans pulled from the lenders' websites. The ranges contain rates offered to applicants with a wide range of credit scores and for a variety of repayment options and terms.

The specific rate an applicant is offered will depend on your (or your cosigner's) credit, as well as the type of loan and repayment options you choose.

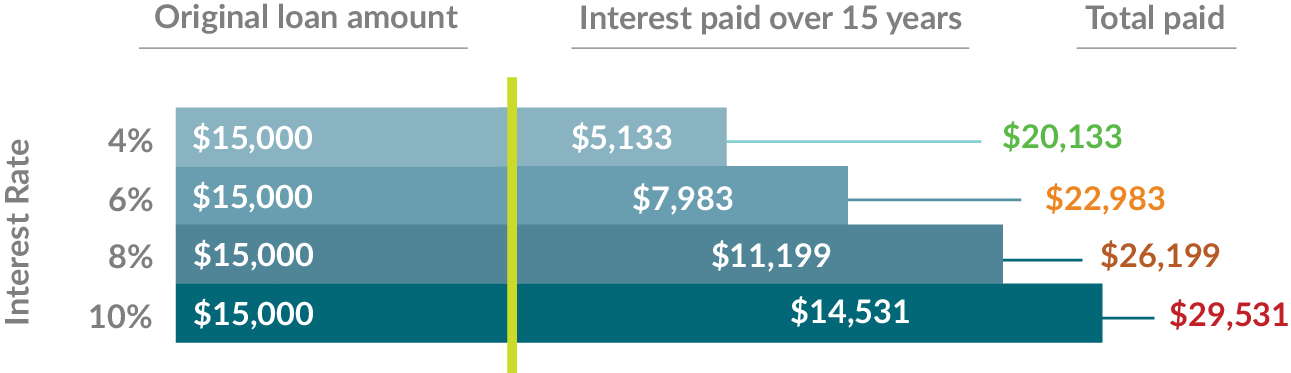

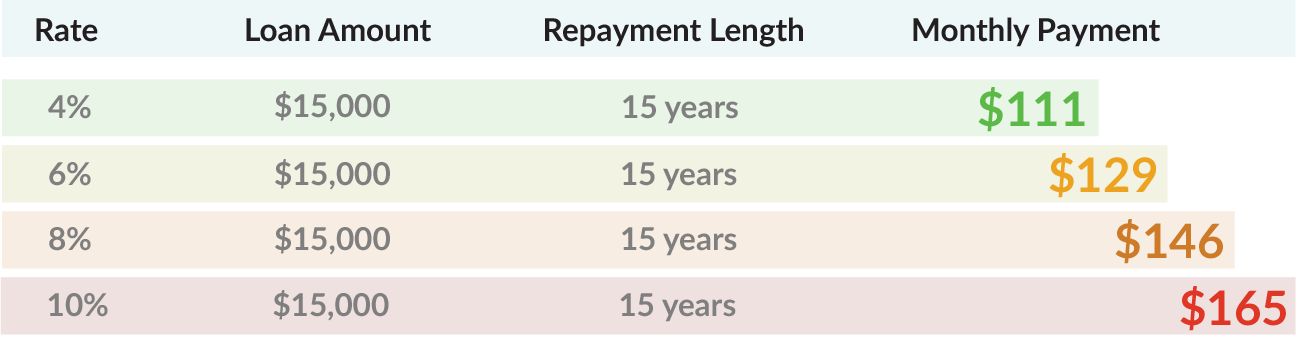

Interest Rates Affect Your Total Cost

A lower fixed interest rate is a good thing, but how much does a difference in rate matter in real dollars—both the amount you’ll pay per month and the total over the entire term of your loan?

Think a few percentage points won't matter? Think again. Here’s an example that shows the different amounts you could expect to pay monthly and in total, based on 3 possible hypothetical rates.

Explanation: This comparison example is based on a loan amount of $15,000, with no fees, paid over 15 years. The rates featured are three possible fixed interest rates you might find in the college loan marketplace today. These rates do not reflect the offerings of a particular lender.

The lower the interest rate, the less you'll pay in interest over the life of the loan. Below are 4 examples of rates you may receive.

Interest Rates Affect Your Monthly Payment

The lower the interest rate, the less you'll pay in interest over the life of the loan. Below are 4 examples of rates and the monthly payment for an immediate repayment student loan.

How Much Will You Need?

The amount you spend determines how much you’ll have to pay back. Loans should be the last stop in financial planning after you’ve received grants, scholarships, and federal aid and checked savings. To decide your loan amount, use this formula:

1. Add up your cost of attendance.

Your cost of attendance (COA) includes tuition and fees, room and board, transportation, books, and personal items throughout the year. It’s easier to plan for the school year instead of a single semester, because you should expect your COA to be the same.

2. Subtract your total in grants and scholarships.

These are gift aid—funds you don’t have to repay. If you’ve been offered work–study (money you can earn by working at a campus job), you may also be able to subtract those dollars from your costs, depending on how your school handles those offers.

3. Look into savings.

If you have savings, consider how much you can use to pay for college. Even $500 of your own money becomes $500 less you have to pay back with added interest. All VSAC Student Loans require a cosigner, so consider asking your cosigner and family and friends if they’re able to offer some additional money to keep the costs of your loan low.

4. Do the math.

If you still have a balance due after the first three steps, it’s time to look at loans. Remember that federal student loans should be your first choice because they offer flexible repayment options like Income-Based Repayment. Because there are loan limits for each academic year that you are in school, you may still need additional loan funds. Once you’ve exhausted all your free aid and federal student loan options, compare federal parent loans and private lenders like VSAC.

Six Things to Consider When Comparing Student Loans

1. Interest rates—A lower rate saves you money.

- An interest rate is the cost of borrowing money. The lower the rate, the less that will be added to your original loan amount.

- A fixed rate stays the same over the life of the loan. VSAC only offers fixed rates.

- A variable rate changes with the financial markets (meaning that it can increase or decrease). Variable-rate loans often have lower initial rates, but these rates may rise over time and cost significantly more over the life of the loan.

2. Fees

- Loans can have fees, either when the loan is made or when repayment starts, and you may end up being charged higher fees than the ones you saw advertised. Some lenders won’t provide complete details about their fees until after you’ve applied.

- The most common fee is an origination fee, which is charged when you take out a loan. Origination fees vary between lenders, but they go directly to the lender as payment for processing your loan. Even federal PLUS loans charge a 4.228% origination fees for student loans. VSAC wants your money to go to your education; that’s why we don't charge fees.

3. Repayment options—find out:

- when repayment begins and the amount of the monthly payments

- the number of years it’ll take to pay off the loan (also referred to as 'term length')

- whether you’ll be eligible for periods of reduced payment or temporary suspension of payment if you go back to school or experience economic hardship

- about income-based repayment options or possibilities for loan forgiveness

4. Do you need a cosigner?

Most student loan lenders require a cosigner. Choosing a cosigner with great credit will ensure that you get the best possible rate while you build your own credit. If a lender asks for a cosigner, ask these questions:

- Can that cosigner be released after meeting certain criteria or other conditions? If so, under what conditions?

- Will the debt be cancelled if the borrower or student dies or becomes permanently disabled?

5. Payment responsibility & cancellation

- Some families only want the student to take out the loan; others may prefer that the parent take on the debt. Who’s responsible for paying which loan?

- The student is the borrower for federal Direct Subsidized and Unsubsidized loans. These loans are in the student’s name and only the student is obligated to repay these loans. Parents are not responsible for repaying their children’s federal student loans.

- Both the student and a credit-worthy cosigner are the borrowers for any loan that has a cosigner. A cosigner shares responsibility with the student borrower for repaying the loan if the student can’t make the loan payments. Most lenders, including VSAC, require a cosigner for a student loan.

- The parent is the only borrower for federal Direct PLUS loans for parents, for VSAC’s parent loan, and most parent loans from private loan lenders. These loans are in the parent’s name and cannot be transferred to the student.

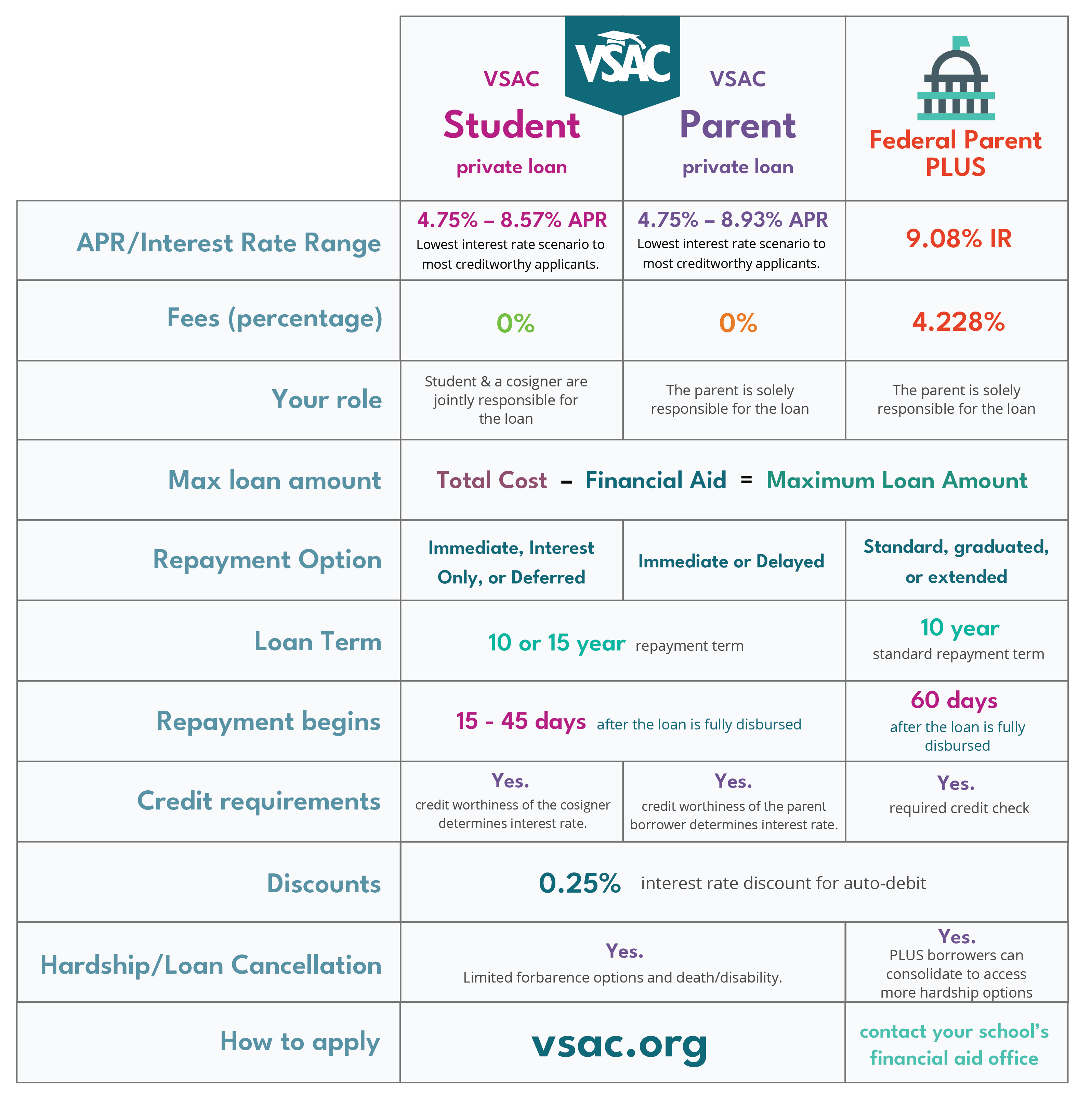

6. How to compare parent PLUS loans

My student’s financial aid package includes a Federal Direct PLUS loan. Should I accept it?

This is one of the most common questions we get each year.

Federal parent PLUS loans are designed for parents to cover up to the full remaining cost of a student’s attendance. They’re provided by the federal government and offer:

- fixed interest rates

- various repayment plans, including income-driven options

- 10-year repayment term

They sound great, but they may have higher interest rates compared to private loans.

Before accepting a federal PLUS loan, consider whether a private loan may offer a better deal for your situation.

How Do Credit Inquiries Affect Your Credit Score?

You might believe that if you shop around for loans, every inquiry into your credit will have a negative impact on your credit score. Not so.

In general, the credit bureaus expect borrowers to “rate shop,” so if credit bureaus see multiple inquiries for a similar loan type within a certain timeframe (30 days is a good rule of thumb, though this can vary), they consider the activity to be a single inquiry against your credit score.

So, if you’re not offered loan terms (rates & fees, for example) that you expected when you applied for a particular loan, stop your application and shop around.

Explore VSAC student & parent loan rates and benefits

About Your Interest Rate

1Lowest APR's are available for the most creditworthy applicants, Immediate Repayment, lowest term option and include VSAC's 0.25% interest rate discount.

2APR's for student and parent borrowers assume a $10,000 loan where the student attends school for 4 years and 2 equal disbursements in the first year.

For Student and Parent Loan Immediate Repayment, loan enters repayment at final disbursement. For Student Loan Interest Only and Deferred Payment, loan enters repayment after 4 years. For Parent Loan Delayed Repayment, loan enters repayment one year following final disbursement.

To receive a 0.25% interest rate discount, the borrower must enroll in VSAC’s auto debit through LoanPay. The interest rate discount benefit is for VSAC Student, VSAC Parent, and VSAC Choice loans with credit approved on or after May 16, 2024, for the 2024–2025 loan product year. The discount applies during active repayment when you make full or agreed upon reduced payments, as long as: (1) Your monthly payment is successfully withdrawn from the authorized bank account each month; (2) All your VSAC loans are 15 days or less past due; and (3) You agree to receive paperless statements. The interest rate discount is suspended during no-pay forbearance, after 3 consecutive failed payments, or if you cancel paperless statements or auto debit. The interest rate discount will not be reflected in the credit agreement, or disclosures you receive. You must enroll in VSAC’s auto debit through LoanPay when your loan enters repayment.

VSAC reserves the right to modify, terminate, or discontinue borrower benefits at any time, at its sole discretion.