Federal Direct Loan vs PLUS Loan

Federal Direct loans are offered by the U.S. Department of Education to eligible students and parents to help cover the cost of college or career training. These loans come with fixed interest rates and flexible repayment options. There are three main types of Federal Direct Loans:

1. Direct Subsidized Loans: These loans are available to undergraduate students whose FAFSA application shows they require additional financial support. The U.S. government pays the interest on these loans while the student is in school at least half-time. They also cover the interest during the grace period after leaving school, and during deferment periods.

2. Direct Unsubsidized Loans: These loans are available to undergraduate and graduate students, regardless of their financial status. Unlike subsidized loans, the student is always responsible for paying the interest on unsubsidized loans.

For both loans, students are the sole borrower and responsible for repayment. For all loan offers, you aren’t required to borrow the full amount. We suggest families only borrow what they need.

3. Direct PLUS Loans: This is a loan for parents of students. The parent is the only borrower for PLUS loans and the loan cannot be transferred to the student.

Like the Direct Unsubsidized Loans, interest will accrue interest once the money is sent to the school.

Parents, it’s your choice whether or not to borrow some or all of the amount offered. Federal PLUS loans have flexible repayment options, such as deferment during periods of hardship. PLUS loans interest rates may also be higher than available alternatives, unlike federal Direct loans for students.

Before borrowing the PLUS loan, pause and shop around for a loan with the best rate and other benefits for your situation. Compare VSAC’s latest loan rates compared to common competitors.

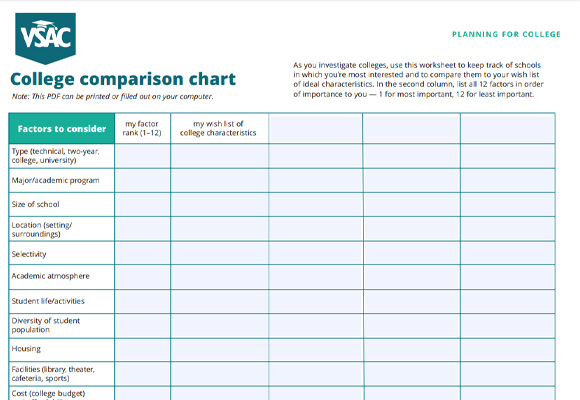

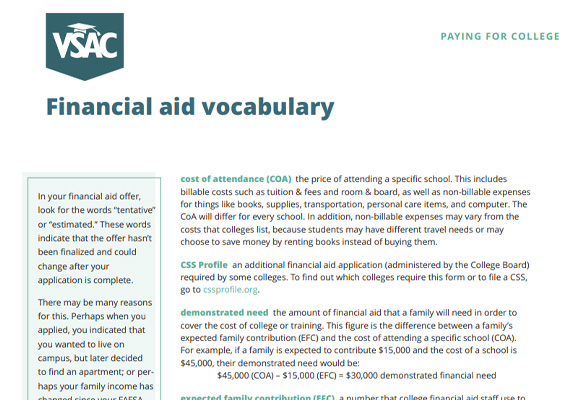

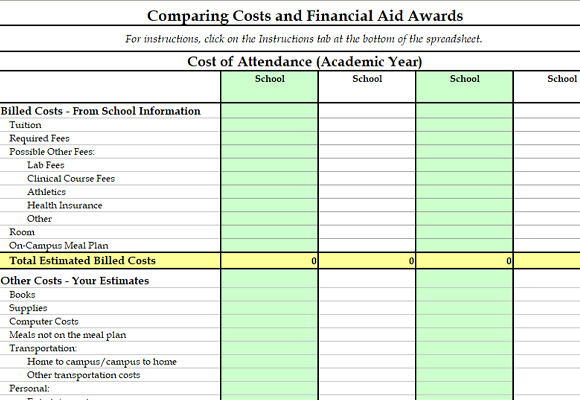

Once you’ve separated free aid from loans, it’s time to crunch the numbers and get the full picture of your financial aid offers, along with your potential costs. This will help you identify the school that gives you the best deal.