Planning for college or training this year? Apply for the Vermont Grant.

How Student Loan Interest Works

When you take out a student loan, you agree to pay back the loan, plus interest. Your interest rate is the cost of borrowing the money. There are 2 types of rates:

- Fixed interest rates stay the same over the life of the loan.

- Variable interest rates change with the financial markets (the rate can go up!). Variable rates may seem great at first but can end up costing a lot more over the life of a loan.

How Interest Accrues on Student Loans

Interest is the fee you pay the lender—such as VSAC or the federal government—in exchange for borrowing the lender’s money. Your interest rate is the percentage of your loan amount (called your “principal”) that you'll be charged for each year that you hold the loan. In addition to this loan amount (or principal), interest accrues (or builds up) on a daily basis. So you accrue 1 days’ worth of interest for each day you owe a balance to the lender.

How Payments Are Applied

Each month, your loan payment is prorated (or distributed) based on the amount due. Your payment is first used to pay any interest that has built up since your last payment. Then, the rest is used to pay down your principal. If your payment is late, the funds will be applied to the most past due loan group(s) first.

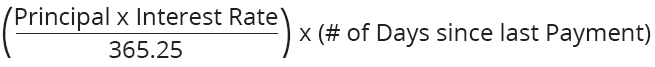

To estimate how much loan interest has built up since your last payment, use this calculation:

How to Pay Less Student Loan Interest

One of the best ways to reduce student loan interest is to pay extra—even if it’s just a little bit—with each payment.

Here’s why:

Your interest is calculated based, in part, on your principal amount. So the lower your principal, the less interest you’ll have to pay each month. Plus, when your principal balance reaches $0, you have successfully paid your loan in full—and you no longer need to pay principal or interest.

So the goal is to pay down the principal as quickly as possible.

If you send more than the amount due each month, the extra funds are first applied to any outstanding interest and the remaining amount goes directly toward paying down your principal. This helps you to pay off your loan more quickly—and reduce your total estimated interest charges.

5 Tips for Reducing Your Student Loan Interest

Here’s how to keep your student loan interest charges as low as possible:

1. Make your payments on time

2. Pay a little extra with each payment

3. Avoid extending your repayment term

4. Avoid deferring your interest payments

5. Avoid defaulting on your loan

How to Prepay Your VSAC Loan

Did you know that many students start paying their student loans while they’re still in college—even when it isn’t required? It’s true—and it can be a very good idea. Starting repayment early can help you graduate with less debt and put you in a better position to repay your loan.

With VSAC loans, it’s easy to start repayment early or to pay off your loan early (called “prepaying”). You may prepay all or a portion of your VSAC loan(s) at any time, without penalty.

When you make your monthly payment, include any special instructions you may have for the payment on your monthly payment coupon.

To pay your loan(s) in full, you must pay the principal balance plus any outstanding interest. Contact us for your payoff amount.